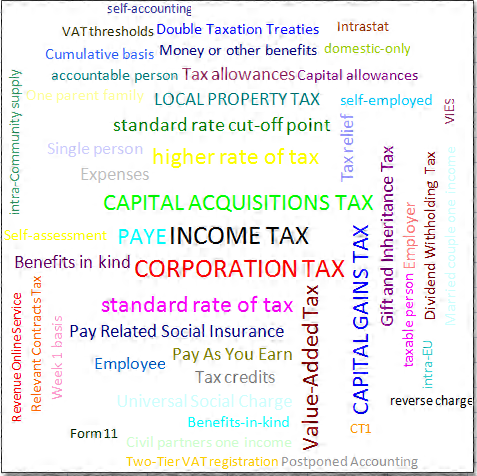

We can help you minimize your tax liability, pay proper taxes and stay compliant with the relevant regulations. We have the knowledge and expertise to provide you with personalized tax planning and compliance services. We offer a range of tax services including tax planning, preparation of tax returns, and representation before tax authorities.

We understand the complexities of the tax system and are committed to helping our clients navigate the tax landscape.

Our Taxation Services include:

Pay As You Earn (PAYE):

We can assist you with your Pay As You Earn PAYE obligations. We will ensure that your payroll is set up correctly and that your employees are paid accurately and on time. We will also handle all of your PAYE compliance requirements, including filing your returns.

Value Added Tax (VAT):

We can help you manage your VAT obligations. We will ensure that you are registered for VAT if necessary and that you are charging and collecting the appropriate amount of VAT on your sales. We will also handle all of your VAT compliance requirements, including preparing and filing your VAT returns.

Income Tax:

We can assist you with your personal income tax obligations. We will help you prepare and file your Self Assessment tax return, ensuring that you are claiming all available deductions and credits

Corporation Tax:

We can assist you with your corporate tax obligations. We will help you prepare and file your Corporation Tax returns, ensuring that you are claiming all available deductions and credits. We will also advise you on tax planning strategies to minimize your tax liability and ensure that you are compliant with all relevant tax laws and regulations.

We are committed to providing our clients with high-quality taxation services. We have the knowledge and expertise to help you navigate the complexities of the tax system and ensure that you are compliant with the relevant tax laws and regulations. Contact us today to learn more about how we can help your business succeed.